Introduction

Welcome back to the capsule series on the evolution of the rocket market. Today, we are going to analyze how the medium rocket market will evolve. For anyone wondering, these rockets are, according to the LV NASA Classification, characterized by carrying between 2,000 and 20,000 kg of payloads to LEO.

We will examine how different companies are moving in this regard, spanning both government and commercial agencies. And, on top of everything, we will look at the differences between different geographic locations, going from the United States to Japan, while passing through Europe and China.

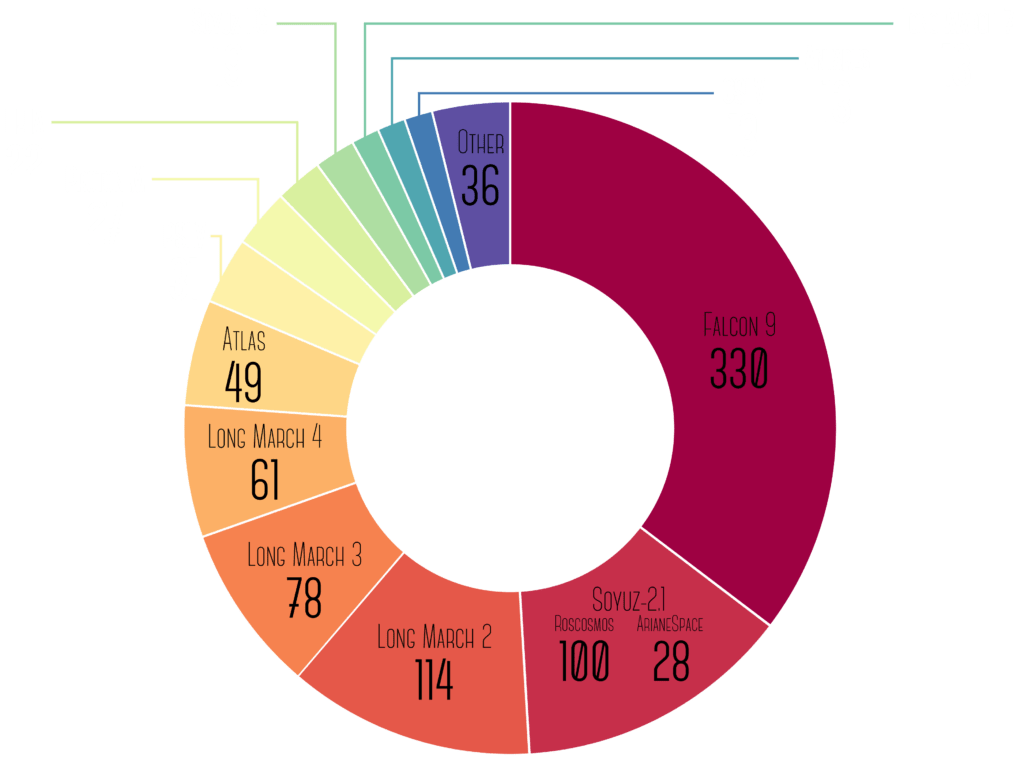

Without further ado, let’s start our analysis with a graph showcasing the rockets that have defined and continue to define the medium rocket market. This graph, taken from our Operator Statistics page, serves as an introduction for where the rockets we will discuss fit into the market.

When talking about Medium Rockets, we cannot fail to mention the great Falcon 9 and Soyuz ones. These not only lead the market but also serve as design inspirations for the others, as we will see shortly.

In this market led by SpaceX — with over 300 launches — and the Chinese Long March rockets — with over 250 launches — we expect to see these big players get further solidified, while European (Ariane 62 and Vega C), Indian (PSLV and GSLV), Japanese (H3), US (Neutron), and Chinese (many) rockets continue to join the fray.

Now, it is finally time to answer the following question. What does the medium rocket have in store for us in the next few years?

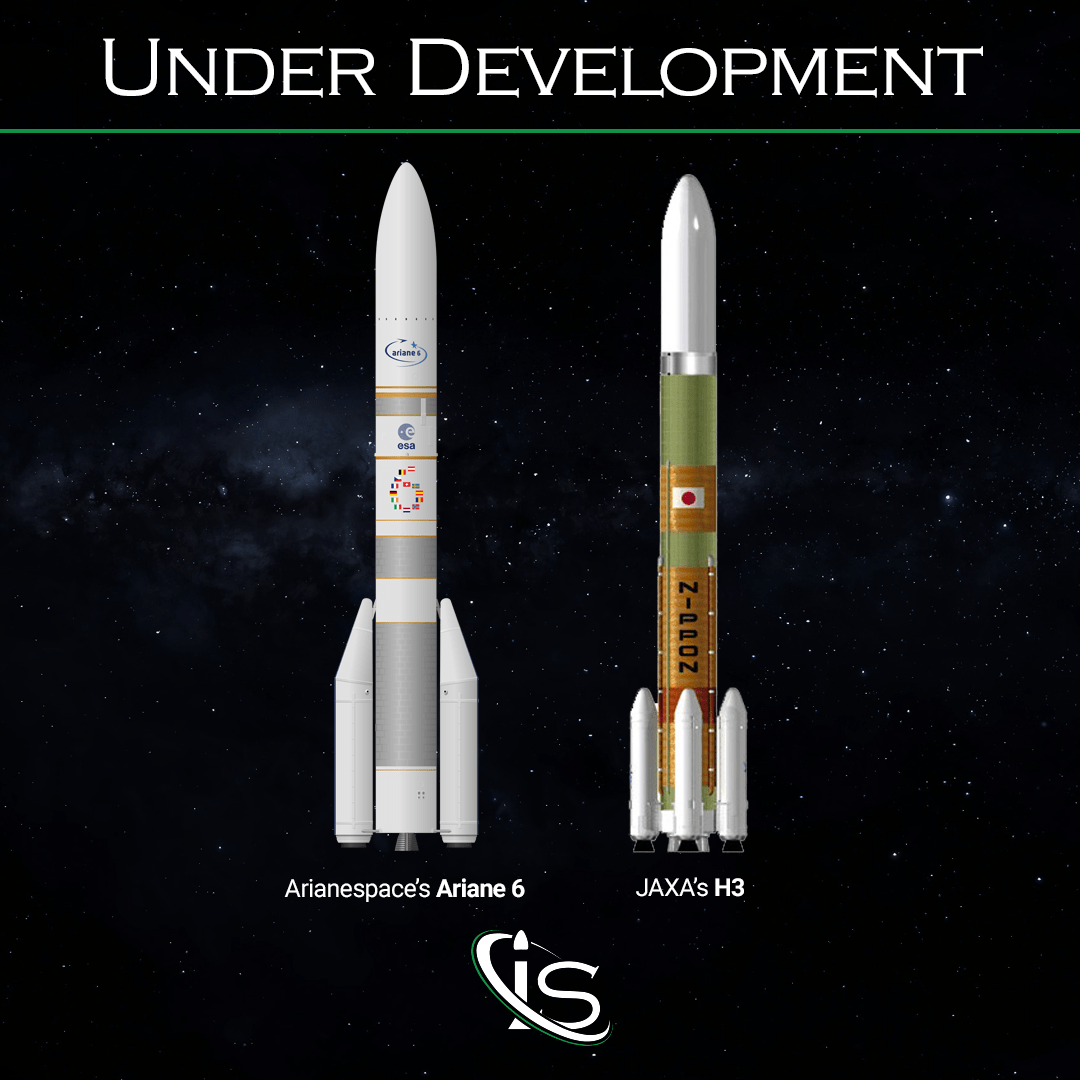

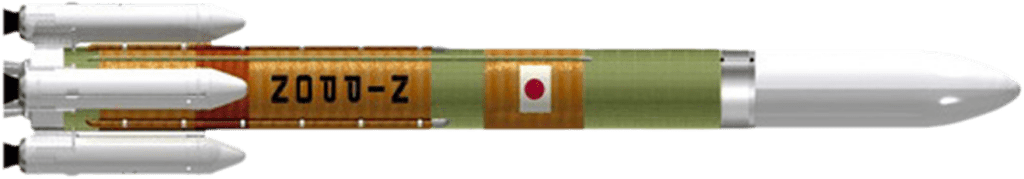

H3

Let’s start with a rocket that’s already seen flight. H3 conducted its second test flight, and first successful one, in February. In fact, February 2023 was the time of the first unsuccessful test flight. And exactly one year later, JAXA tried again, this time with three smallsats on board.

H3, as we saw with some of the Heavy rockets, has a very flexible configuration. The number of boosters and engines, as well as the fairing’s size, can all be changed. H3 models are defined as follows:

H3-24L

where:

H3: Rocket’s name

2 = the number of LE-9 engines (2 or 3)

4 = the number of solid rocket boosters (0, 2 or 4)

L = Payload fairing length (Standard or Large)

February’s launch was done with a H3-22S configuration, meaning 2 solid boosters, 2 LE-9 engines, and a Standard fairing.

Ariane 6

We already talked about Ariane 6 in the Heavy Rocket Market Edition. However, here we will be talking about Arianespace’s production of the Ariane 62 rocket, the medium rocket configuration which will have 2 boosters, instead of 4.

Its maiden flight is scheduled for July 9th, from Kourou. A little over a year after the last launch of its predecessor Ariane 5 ECA, the Ariane family is ready to give back Europe’s access to space.

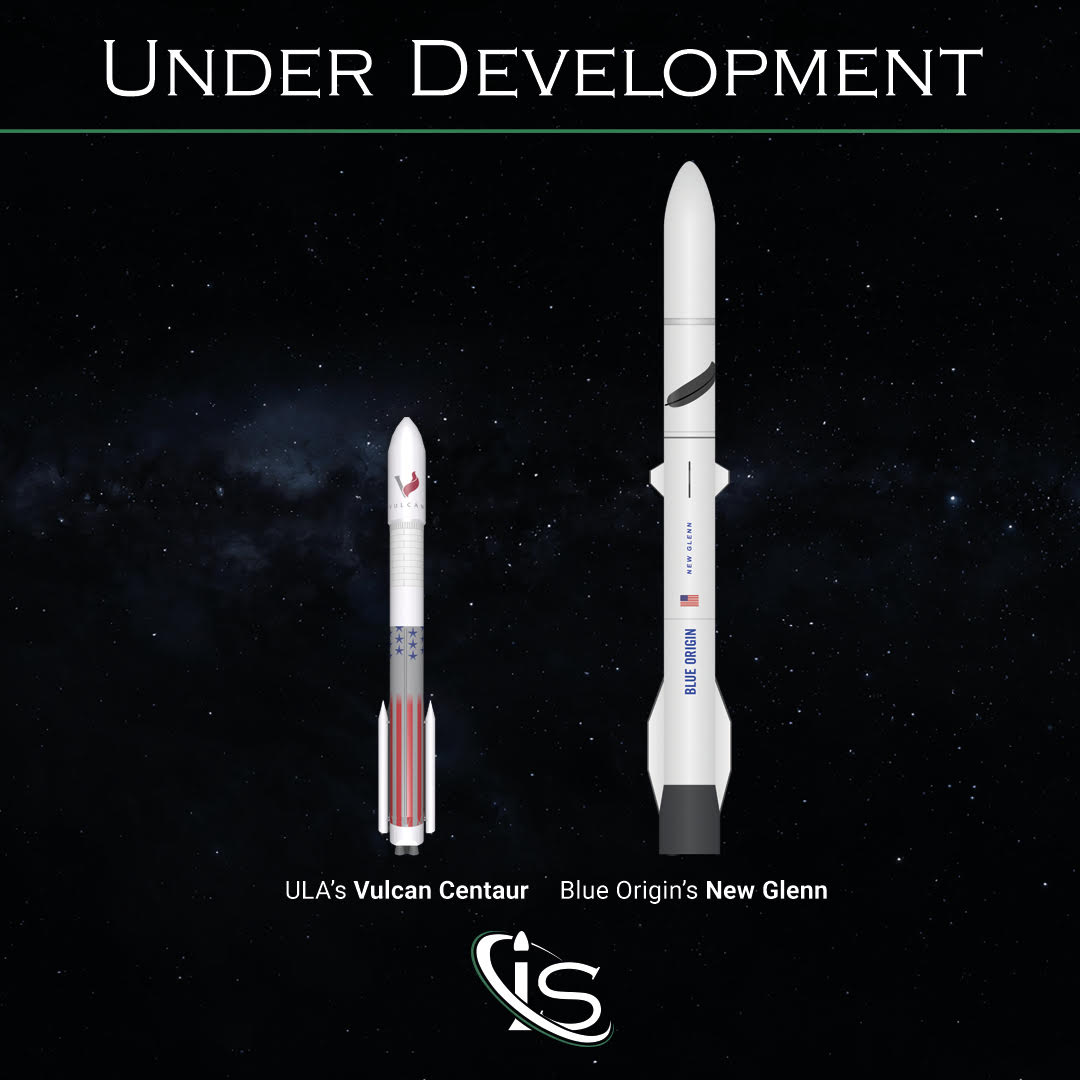

Neutron

Among the news coming from the US, there is Rocket Lab’s Neutron’s inaugural flight. A few weeks ago, while Rocket Lab was readying the tests for the Archimedes engines that will power the rocket’s first stage, the news broke that its first launch is planned to take place around halfway through 2025.

Neutron represents a first in the market due to the fairing structure being integrated into the first stage. This way the first stage will be directly recovered with the fairing half. With its reusable configuration, it will have the capability to LEO of 13,000 kg of payload.

Even from an ecological perspective, Neutron is a step forward compared to Electron, as it will use methane instead of kerosene. You can read the article on Rocket Pollution to see the difference between the two propellants.

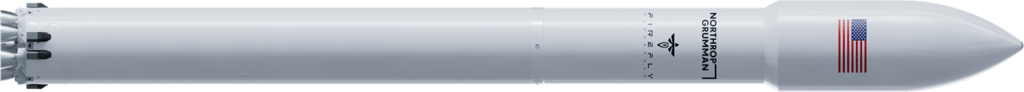

MLV

From the collaboration between Firefly and Northrop Grumman is born MLV, Medium Launch Vehicle. With a capability of over 16,000 kg to low orbit, MLV will be able to serve commercial, government, and institutional launches.

For its maiden flight, we will have to wait until 2025, with no precise window being targeted, yet.

In the meantime, the Medium Rocket Market In China…

China deserves its own chapter here, because the number of medium rockets currently under development there is quite large. While its government agency only has one in the works, the private ones are all in the process of making their own.

Gravity-1

The first rocket to mention has to be Gravity-1, developed by the private agency, Orienspace, whose 4-year anniversary was just a few days ago. Gravity-1, the first of the Gravity family that we will see take to the skies in the upcoming years, represents a record. That being the very short time frame between the founding of the agency and the maiden flight. Less than 4 years, to be exact, as it first launched in January 2024. We are currently waiting for it on the Jiuquan platform for its first land-based launch. Its inaugural flight, in fact, took place on a special converted barge off of the coast of the city of Haiyang.

We would need an entire post dedicated to just Gravity-1 to cover all its records. So, let us know in the chatbox if you would like us to write one.

Long March 12

The Chinese space agency is getting ready to unveil a new rocket of the Long March (Chang Zheng in Chinese) family. Not too much is known about it right now. But, what we do know is that it should have its maiden flight in August 2024, with a capability to LEO of 10,000 kg.

Pallas-1

Galactic Energy is another Chinese agency to pay attention to. After a maiden flight in November 2020, Galactic Energy, with its Ceres-1 rocket, was the third most active launch operator in Q3 2023, surpassing even Roscosmos! But we are not here to discuss Ceres-1. Instead, we are looking at its larger sibling, Pallas-1, which should have its first launch in November 2024. Pallas-1 will not only be able to carry 5,000 kg of payload to LEO (over 10 times Ceres-1’s capability) but, starting in 2025, Galactic Energy will also try to reuse its first stage.

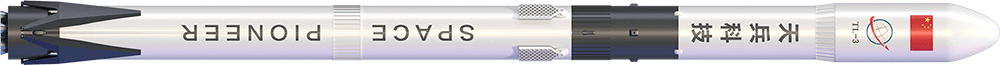

Tianlong-3

Space Pioneer has also presented a new reusable rocket. Tianlong-3’s first stage, in fact, should be able to perform a vertical landing and could be reused up to 10 times.

Beyond its reusability, Tianlong-3 will also have a much greater capability compared to its predecessor, with 17 tonnes to LEO compared to Tianlong-2’s 2. We are expecting to see Tianlong-3’s inaugural flight next September.

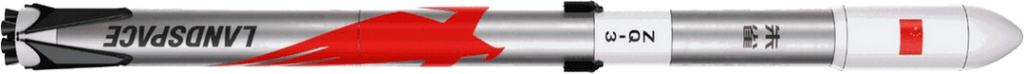

Zhuque-3

The Chinese agency Landspace, after developing its Zhuque-2 rocket, which had two successful launches last year, is getting ready to add a Medium Rocket to its portfolio. We still do not know a lot about Zhuque-3, including a maiden flight window. However, we do know it will be able to carry between 11,000 and 20,000 kg of payload.

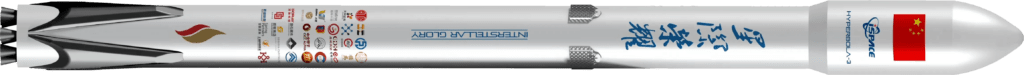

Hyperbola-3

To end this section, we have Hyperbola-3, of i-Space’s Hyperbola family. With 4 successful launches under its belt, the company is developing its new partially reusable rocket, which will have a capability of 13,400 kg in its expendable configuration and of 8,500 kg in its reusable one.

We also do not have a clear window for its first launch, although it will likely take place in 2025.

Summary of the Future Medium Rocket Market

We know we talked a lot and provided tons of information on many rockets, so we would like to take a moment to thank you for following us on this journey around the globe. Below, we added a table to summarize the capability to LEO and maiden flight information on the rockets we discussed today.

| Rocket | Capability to LEO [tons] | Maiden Flight |

| H3 | Mar 7th, 2023 | |

| Gravity-1 | 6.5 | Jan 11th, 2024 |

| Ariane 62 | 10 | Jul 9th, 2024 |

| Long March 12 | 10 | Aug 2024 |

| Tianlong-1 | 17 | Sep 2024 |

| Pallas-1 | 5 | Nov 2024 |

| Neutron | 13 | Q2-Q3 2025 |

| MLV | 14 | 2025 |

| Hyperbola-3 | 13 | 2025 |

| Zhuque-3 | 11-20 |

Follow us on our website and social media platforms to never miss out on space-related contents. See you soon with more stories to tell and deep dives to perform!